by Cullen Roche

Because I am an equal opportunity political hater – I bring you the counterargument of the Paul Ryan story. It’s unfortunate that I even have to write a story like this, but our world has become so divided down party lines that no one appears to be able to filter their economics without first deciding which side of the party line they stand on. It’s no longer about what’s best for America, but what’s best for the political party you back. But this is a good opportunity to lift the veil from some of the myths that surround the nasty politics of economics.

Many have accused me of taking a political stance when writing about the economy and Paul Ryan specifically. That’s simply not true. I often point to the Clinton years as clear evidence that this is not about politics to me, but pure economics. What do the Clinton years have anything to do with our current predicament? Let’s take a look.

The 1990′s were characterized by enormous prosperity in America. A multitude of factors combined to form one of the great economic booms in the history of modern economies. And our government used this opportunity to invoke some politics into the mix. In the late 1990′s our politicians started worrying about our national debt. The rhetoric about America going bankrupt became a persistent theme. And we took drastic measures to combat this supposed threat. Bill Clinton spearheaded the movement towards fiscal responsibility.

So, the government dramatically reduced the budget deficit and sent the US economy briefly into budget surplus. The government was saving money so they could spend it later! Unfortunately, that’s not how our monetary system works. The US government never needs to save in order to be able to spend. The government, as a monopoly supplier of the currency they require us to transact in, is nothing like a household, state, European nation or business.

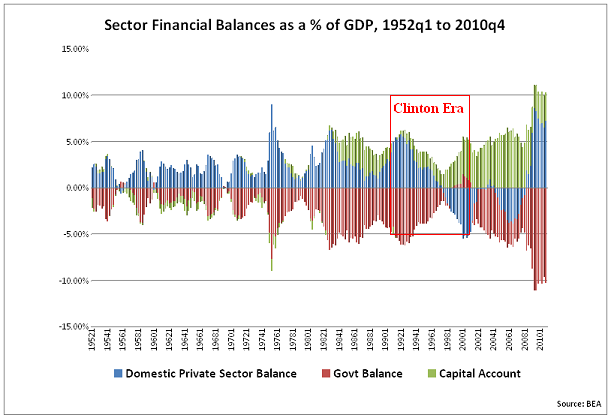

What happened next directly contributed to the current malaise in the US economy. If we look at the sectoral balances we can see exactly what the Clinton surplus did. As the US economy was running a current account deficit in excess of 2% in the mid 90′s the US government began to shrink the deficit.

This wasn’t entirely misguided, however, it was taken to an extreme. As the current account remained steady near 2% the government’s balance continued to shrink and went positive in 1999. All the while the domestic private sector is being driven into deficit. Why? Because the government was not spending enough to allow the domestic private sector to net save. So what happens as Americans attempt to counteract this?

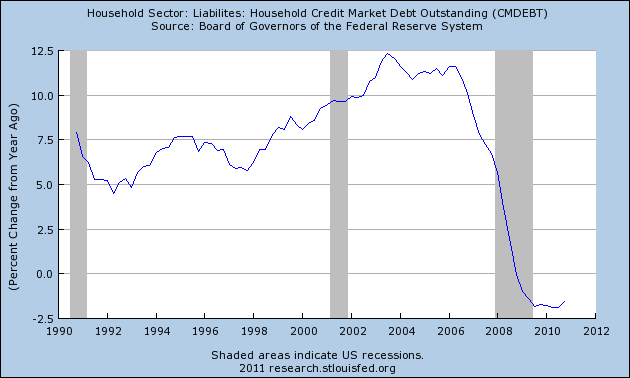

They fund their lifestyles in other ways. This means going into debt. As you can see from household debt levels Americans were taking on an increasingly large amount of debt in order to sustain their lifestyles. We all know what happened in 2000 as the dotcom bubble burst and the economy was thrown into a tailspin. The recession, in many ways, alleviated many of the excesses. This is the natural curing process of the business cycle and capitalism. It is a good thing. But I would argue that the Clinton surplus started the American public on the path towards a debt binge that would not end for another 7 years. It’s not a mere coincidence that the greatest debt binge in American history began during the end of the Clinton years. I believe this can be traced directly back to the Clinton surplus as the sectoral balances clearly show. Of course, there were more moving parts to it than just this, but the surplus played a key role in getting the wheels in motion. And so the seeds were sown for a much larger crisis.

The handling of the economy under the Bush administration is a different chapter in the story, but the moral of the story here is clear – this isn’t about politics. I don’t care for Paul Ryan’s or Bill Clinton’s politics. All I know is that their economics stink. And as we’re all finding out now, America is only as good as its economy and America’s economy is only as good as the people who formulate policy. Clinton sustained a good economy for much of his Presidency. Unfortunately, the wheels came off towards the end and his attempt to fix the US government’s fiscal “problems” played a key role here. Paul Ryan’s plan would catapult us towards the exact same situation. But again, let’s not allow the politics to cloud the economics at work here and like it or not, Ryan’s plan is bad economics given the current balance sheet recession. Just like the Clinton surplus was bad economics in the late 90′s.

Obviously, there are many more moving parts to the current malaise than just government spending and the squabbles between Republicans and Democrats, but I hope you’ll take one thing away from this story – the success of America isn’t about one party being right and the other being wrong. Most politicians don’t have the first clue about the workings of the monetary system so the odds are that they’re all wrong regardless of what they believe. But that doesn’t mean we should accept bad economics just because it fits with our personal political beliefs. Both parties have made enormous mistakes over the last 25 years. Ignoring good economics in favor of politics is no way to get this ship righted.

No comments:

Post a Comment