By Lance Roberts

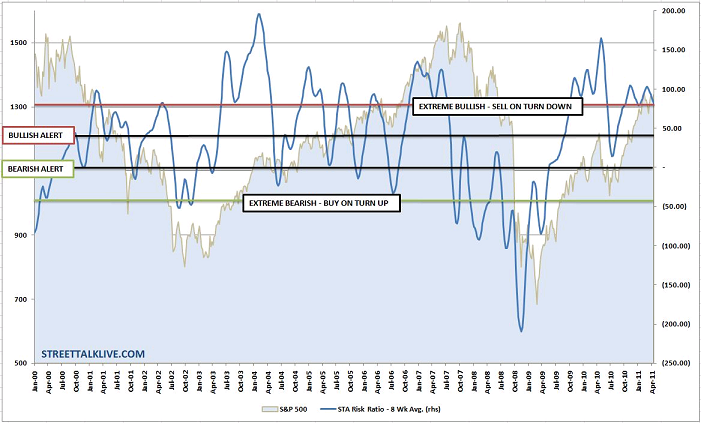

Our proprietary risk metric is beginning to throw off a warning signal which comes just as the markets are about to enter their seasonally weakest 6 months of the year. The risk ratio indicator is a weighted average of bullish to bearish sentiment, the volatility index, the rate of change for the S&P 500, and the new high/new low ratio of the NYSE. This weighted average is then smoothed with an 8 week rolling average to eliminate a lot of the noise.

While a lot of people look at these indicators individually we combine, weight and smooth them to provide a more global look at market psychology and sentiment. Currently, that outlook is very bullish which, as a contrarian investment manager, this is a time to begin raising cash and hedging risk in portfolios.

The indicator is best used when it has reached either an alert zone or an extreme zone and THEN turns up, or down, from that level – just getting into the zone doesn’t provided the best degree of accuracy of a change in market direction. It is important to note that the indicator swings from Bearish Alert to Extreme Bullish during bullish upward trending markets and vice versa for bearish downward trending markets.

Currently, the market is in an extreme bullish zone and has been fighting to turn down over the last few months while the markets have remained in a bullish trend during the seasonally strong time of the year. However, the with the markets entering into the summer months with a potential lack of QE to boost the financial markets it is very likely that we could see a repeat of the market action from October 2009 – June 2010 period where the market struggled higher into the end of QE 1, the indicator remained extremely bullish and then turned sharply down in June indicating an exit from the financial markets.

While this is not a failsafe indicator by any means it does provide a decent track record of warnings to increase and reduce risk from equity centric portfolios. We are recommending overweighting bonds and underweighting equities for the summer months until this indicator reaches a Bearish Alert zone and turns up…or the introduction of QE 3…whichever occurs first.

No comments:

Post a Comment