Interesting article at Zero Hedge over the weekend (here and follow-up via Alphaville here) – where Tyler speculates as to whether the Fed has been aggressively selling volatility on Treasuries. The recent plunge in volatility, as measured by the MOVE index, looks remarkably similar to a fall that occurred at the end of QE1. Logic is against such a trade given that the end of QE should herald in more uncertainty not less.

Just how close the theory is to the truth is unlikely to see the light of day in the near term. It’s a persuasive case in some respects – so maybe there is a smoke and fire correlation.

In any event, as the largest single holder of Treasuries, the Fed is clearly very exposed to higher rates – and it’s adding to this risk with every suck on the QE pipe. Should the curve spiral higher for whatever reason, imploding the Fed’s balance sheet, the chances of a Congress led revolt will rise materially. Ultimately, it’s this type of cause and effect that is likely to bring an end to any successive QE…

__________________________________________________________________________________________

Now this is not to say that Treasury yields are about to explode with the imminent pulling of the Fed’s bid. If anything, in the near term it looks like the removal of the liquidity drip is likely to promote a return of Treasury safe haven buying.

To summarise the argument – current risk asset prices have stalled and require ample and growing liquidity to be sustained. Unfortunately, the exact opposite is likely occur – as China and Europe tighten and the US removes the QE stimulus. Therefore we expect risk prices to weaken and equity volatility to emerge from its liquidity induced slumber. In this environment, Treasuries will catch a safe-haven bid.

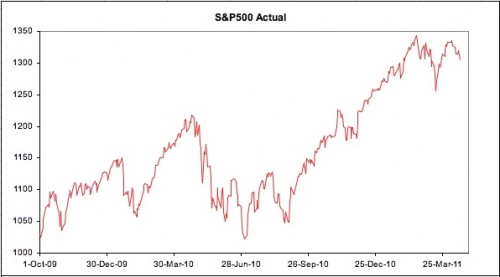

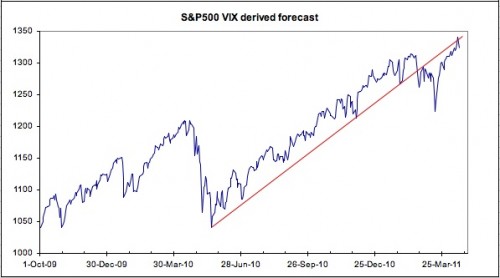

One chart that we follow around here that tracks the relationship between equity volatility and price is the following:

We’d normally look for a divergence between the performance of the actual and implied versions of reality – nervousness in options markets often leads the underlying index. So it’s interesting that the implied model has recently made a new high, while the actual index failed at its last attempt. Either equities have another leg up left in them, or the option pit has capitulated and joined the all-in punt.

No comments:

Post a Comment