There are multiple problems when debates over inflation and deflation break out. The primary problem is that humans tend to be extreme in their beliefs. There is too often no room for middle ground. For instance, I am often taken out of context as a deflationist even though I maintained for the entirety of 2010 that we were likely to suffer disinflation and then earlier this year forecast low levels of inflation in 2011. Nonetheless, because I reject the notion of hyperinflation or even high inflation I am pegged as the extreme opposite – a deflationist. This extremism results in losing sight of the highest probability outcomes (which is likely to be neither deflation nor hyperinflation). It’s great to have conviction in a belief, but it must be tempered by reality and probability.

In addition, humans tend to have very short memories resulting in attentional biases. In the case of inflation we tend to focus on what has happened only just recently as opposed to what has happened around us over the course of several days or months. For most of us, this involves seeing gasoline signs, stock prices, gold prices or other noticeable prices. These biases combine to lead most of us to constantly fret about near-term price changes in highly visible prices. Gasoline prices are rising in the last few months so it must mean that we are on the verge of hyperinflation, right? Not so fast.

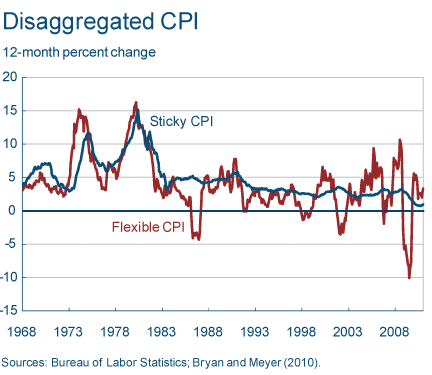

The Cleveland Fed recently devised an inflation index that most readers can likely relate to. It is called the Flexible CPI. This index prices the more volatile measures of CPI and if you look at the chart below you’ll likely relate to the price changes better. Yes, inflation really did feel high in 2007 & 2008 despite the low readings in the core CPI. But the story was not complete just because flexible prices were surging. When many were fretting about inflation their concerns were not without merit, however, they weren’t entirely accurate when one pulls back and looks at prices as a whole.

This is where the sticky prices index comes in. While gasoline prices may be gyrating on a daily basis the price of many other goods and services (such as your rent or mortgage cost) remains relatively constant. The Cleveland Fed elaborates on these indices:

“Another way to analyze the incoming data is to look at where the price increases are coming from. Bryan and Meyer (2010) separate the consumer market basket into “flexible” and “sticky” prices. Flexible-priced items (like gasoline) are free to adjust quickly to changing market conditions, while sticky-priced items (like prices at the laundromat) are subject to some impediment or cost that causes them to change prices infrequently. As their research shows, sticky prices appear to have an embedded inflation expectations component that is useful in forecasting future inflation.

As is evident in the figure below, the flexible price series is definitely more volatile, and does appear to vary with changing economic conditions. The sticky price series has been relatively stable since 1983, usually hovering between 2.0 percent and 3.0 percent. However, over the past two years the sticky CPI has experienced a sizeable disinflation—slowing from a year-over-year growth rate of 2.8 percent in December 2007 to a low of 0.7 percent in September 2010. Since then, the sticky CPI has edged back up slightly and is now trending at a 12-month growth rate of 1.0 percent. The flexible CPI, which fell to a year-over-year growth rate of -10 percent during the depths of the last recession, has popped back up to a 12-month growth rate of 3.4 percent through January.”“The flexible CPI is intriguing in that, by design, it is likely to show evidence of pricing pressure ahead of the sticky CPI. However, the series is very volatile relative to its sticky-price counterpart and likely dominated by relative price changes. As a result, inflation forecasts based on the flexible CPI perform rather poorly.While rapid price increases in a few categories seem to have pushed up the headline CPI lately, underlying measures of inflation are relatively low and have only ticked up slightly in the past few months.”

The study referenced above elaborates further:

“We find that forecasts of the headline CPI that are based on the sticky-price data tend to be more accurate than the forecasts based on headline inflation. Further, CPI predictions using sticky-price data perform pretty well relative to CPI forecasts using core CPI data.6,7. We also find that the relative accuracy of the sticky-price Phillips curve increases as the forecast horizon gets longer. For example, when predicting three months ahead, we find that the sticky-price Phillips curve reduces the RMSE of the forecast only about 2 percent relative to the headline CPI. For the 24-month ahead forecast, the improvement in the RMSE was about 14 percent. The flexible-price measure, at least on the surface, does not seem to forecast well, and it performs increasingly worse as the forecast horizon gets longer.”

This doesn’t mean that flexible prices are always wrong. But we must remember not to be too biased about near-term highly visible price increases. There’s more to the story than that. And as we learned in 2008 a short-term spike in flexible prices can occur just months before a nasty deflationary event. Given that there are many similarities between 2008 and the current environment it would not be surprising if flexible prices continued to surge into the summer months before triggering their own self correcting mechanism in the form of reduced aggregate demand and slower economic growth. So while surging flexible prices are important to keep an eye on it’s equally important to remember that flexible prices are only one piece of the overall inflation story.

No comments:

Post a Comment