With the UN food price index at decadal highs, the time for recriminations is upon us. In the firing line are speculators, national governments, the Fed, trade policies and the topic of today's discussion, biofuels.

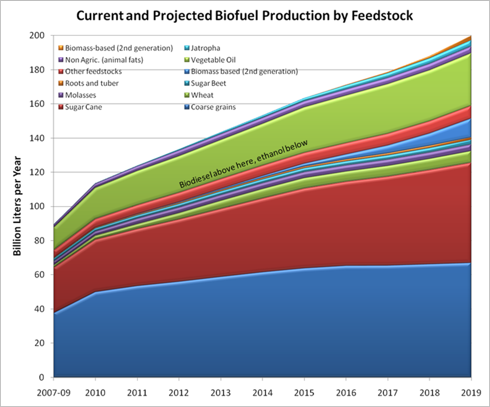

For 2010, the UN Food and Agicultural Organization has estimated/predicted global production of 92.5 billion liters of ethanol and 21 billion liters of biodiesel, which is up from the average of 74.2 billion liters ethanol and 15 billion liters biodiesel from 2007-2009. Under current developed world policies, this is projected to rise to 159 billion liters ethanol and 41 billion liters biodiesel by 2020, almost all of which will be from first generation feedstocks.

Ethanol has an energy content of 24 MJ/liter and biodiesel 33 MJ/l, so the energy content for 2010 of the combined total is approximately 800 TWh. If a person requires 2,500 Calories per day (2.9 kWh), then this would feed, in theory, 750m people for a year. Whether using this for cars is ethical or not I'll leave up to you. (Hint: It isn't.)

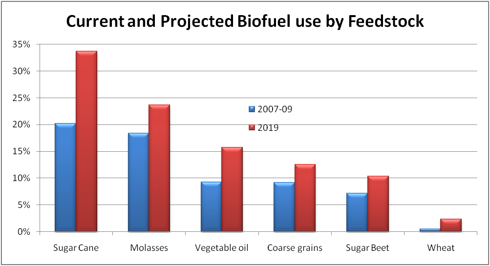

The rising proportion of the various feedstocks diverted for biofuel use is shown below:

[Click to enlarge]

While disentangling the factors behind the recent price increases is very difficult, diverting up to 10% of global food calories to fuel cars is unlikely to have helped. It greatly reduces the margin for error in years with poor yields. It turns out food price volatility is a national security issue, too, as in MENA, so perhaps this will focus minds in Berlin and Washington to rescind the RFS2 and RED directives, in which case the proportion of grains used for biofuels would promptly plummet.

Happily, the GAO agrees that ethanol subsidies are a mess:

The U.S. General Accounting Office last week, disappointing the ethanol industry, issued a report saying that the excise tax credit and the RFS requirement "can be duplicative ... and can result in a substantial loss of revenue." The GAO put the cost of the tax credit at $5.7 billion. Meanwhile, a group of 90 different organizations called on Congress to end ethanol subsidies. The ethanol industry is going to have a hard time maintaining the tax support measures when they expire at the end of this year.

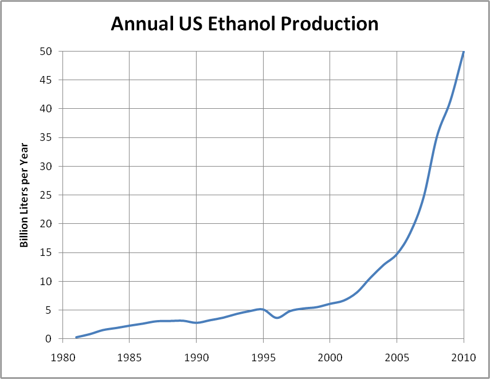

U.S. ethanol production is shown below, reaching the towering heights of 50 billion liters last year.

The proximate impacts of the removal of ethanol subsidies are likely to be January 2012 corn prices in freefall and oil prices sharply higher. December 2010 ethanol production was 918,000 barrels per day. Converted to oil equivalent, that's 0.6 mb/d. With OPEC spare capacity at most 2 mb/d, the loss of this oil supply would be, shall we say, problematic.

The proximate impacts of the removal of ethanol subsidies are likely to be January 2012 corn prices in freefall and oil prices sharply higher. December 2010 ethanol production was 918,000 barrels per day. Converted to oil equivalent, that's 0.6 mb/d. With OPEC spare capacity at most 2 mb/d, the loss of this oil supply would be, shall we say, problematic.

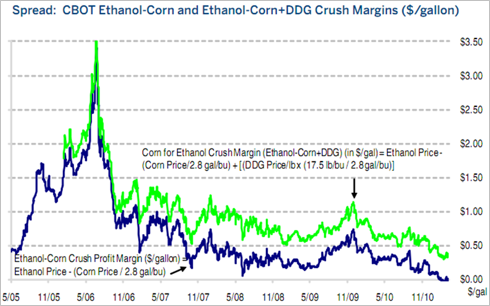

One way to play would be to go long the 2012 corn crush, although perversely if the corn crush blew out too much, ethanol might become competitive without subsidies. The corn crush is currently at historically low levels:

See the original article >>

No comments:

Post a Comment