by Bruce Pile

How many times have you heard pundits say not to worry about a high oil price because we have high inventories of the stuff? It's like a mantra with them.

It's all speculation, they keep saying, and there is no problem with supply. So now, as oil goes over $100 a barrel with high inventory, we have the Saudi Oil Minister Ali al-Naimi responding by saying, "We cannot put oil in markets that don't need it." And we have this further reassurance from OPEC Secretary-General Badri on the startling rise in the price of oil lately:

Badri said oil inventories would need to be drawn down to warrant an increase in OPEC supplies.

He told Reuters Insider OPEC would raise output if oil stocks in the industrialized economies fell to the equivalent of 53 days of future demand. The latest estimates put these stocks at the equivalent of around 58 days of demand.

"If after 2-3 months stocks come down to 53 days, we will increase production ... we cannot increase production because of speculation," he said in an interview.

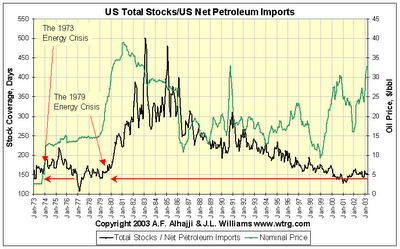

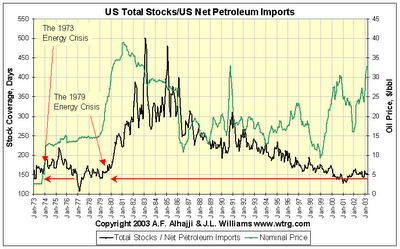

Have these people and everyone listening to their nonsense ever looked at an inventory history chart? Just what is the proper relationship between the price of oil and the amount that is on hand? You would think, as most everyone does, that the more of it we have, the less justified any price climb would be.

But what does history actually tell us? All things considered, it tells us this: (click to enlarge charts)

See the original article >>

No comments:

Post a Comment