By Rohan Clarke

The unwind of the carry trade has been in full swing for a couple of days now. It’s probably been accompanied by repatriation of capital by Japanese investment trusts and the like – time will tell. Given the bounce in USDYEN from this morning’s lows – without the aid of intervention – it’s likely that the peak of this flow has passed. Still, the withdrawal of the world’s best savers from the global capital markets can be expected to put upward pressure on interest rates from here on in.

The next phase of the crisis, as it will be played out in capital markets at least, will unfold over a couple of weeks as the impact on individual actors become clearer. Given the enormity of the events, it is unlikely that we will see a return to the optimism of a week ago – bounces in risk assets will be sold into.

The response from global governments, if they stick to the same script, will be to once again turn to the stimulus levers. Given that these have been overused of recent times, fiscal policy options are now somewhat constrained. As a result, it’s likely that ‘unconventional monetary policy’ will remain a feature of the landscape. In the US, the liklihood of QE3 being pre-announced ahead of the closure of QE2 has just risen dramatically.

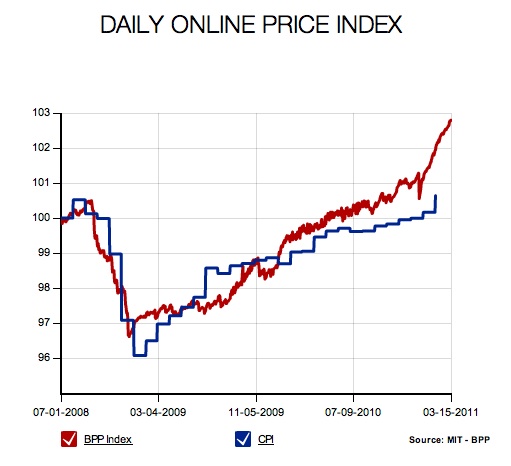

So while we can argue cause and effect, fears of further price rises in real goods may be amplified by the crisis in Japan. It’s in this context, that an update of the Billion Prices Project price index for the US is in order:

See the original article >>

No comments:

Post a Comment