Trading was the original sin that enabled capitalism. Without it, the snake would still be holding the apple.

It would be as well to remember this when considering the latest innovation in financial markets – High Frequency Trading. There is nothing fundamentally new about it - other than its acronym (HFT). It is just trading done really fast.

The practice of trading

At it’s simplest, trading is the practice of facilitating a market. For example, consider a two-way price, let’s say 20/25 – you are prepared to buy at 20 and sell at 25. If a buyer takes your offer to sell at 25, you then lift your two-way price – to say 23/28. In an active market, that higher bid price is what another agent, a seller, has been sweating on – they pounce on your 23 bid. The snake called this two steps forward-one step back process ‘negative auto-correlation’. As a trader, you call it ‘making the spread’.

As defined, trading has a few key characteristics:

- Traders do not take directional positions – They make money by facilitating trade, through understanding the market and its participants. They may use their balance sheet to warehouse positions temporarily, but the primary goal is to make the spread, rather than having a view on which way prices are going.

- Traders like deep and liquid markets – As far as a trader’s concerned, the more participants the merrier, as it’s more likely to give rise to two-way flows. In such conditions, traders will add to the liquidity pool and thereby increase the efficiency of the market. Non-trader participants generally benefit from a tighter bid and offer spread.

- Traders don’t like erratic markets – Conversely, traders do not like illiquid markets that are subject to discrete price ‘jumps’. While a little volatility is a boon for a market facilitator, erratic markets expose traders to directional price movements they would prefer to avoid. Traders will often withdraw their bid and offer in such markets, thereby further reducing liquidity compared to ‘normal’ market conditions.

With these thoughts in mind, let’s turn our attention to HFT.

HFT is a child of technological evolution

While not an ‘early adopter’, like it’s cousins in the sex and military industries, the finance sector does have good form in taking up emerging technologies. HFT is the latest technological driven development to sweep the industry. So what exactly is HFT?

The SEC (here) suggested HFT is ‘typically is used to refer to professional traders acting in a proprietary capacity that engage in strategies that generate a large number of trades on a daily basis’. They go on:

Other characteristics often attributed to proprietary firms engaged in HFT are: (1) the use of extraordinarily high-speed and sophisticated computer programs for generating, routing, and executing orders; (2) use of co-location services and individual data feeds offered by exchanges and others to minimize network and other types of latencies; (3) very short time-frames for establishing and liquidating positions; (4) the submission of numerous orders that are cancelled shortly after submission; and (5) ending the trading day in as close to a flat position as possible (that is, not carrying significant, unhedged positions over-night). Estimates of HFT volume in the equity markets vary widely, though they typically are 50% of total volume or higher.

Not exactly the most eloquent of prose, but if you are still with us, you get the drift – HFT is trading that has been accelerated by using computer processing power to capture the spread, wherever it can be found.

HFT is a good thing – particularly for cyborgs

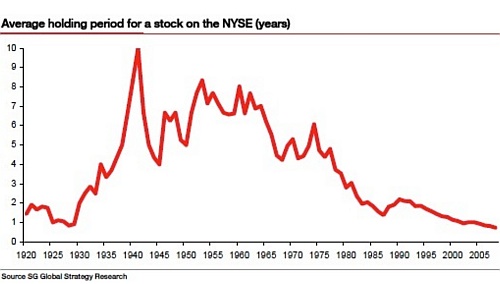

The march of the machine into markets has had a big impact on trading volumes – but has not changed the fundamental nature of trading. We can see the impact in a number of ways. The average holding period for equity investments is approaching a vanishing point (from a Sep09 post here):

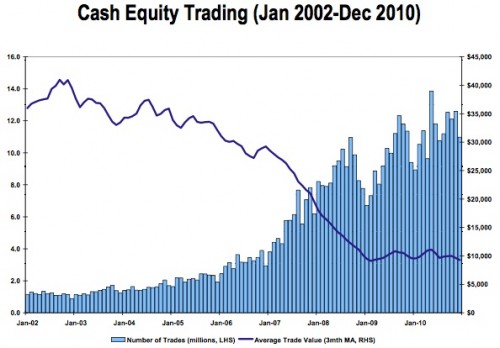

There are many more trades but the average size of each trade is commensurately smaller:

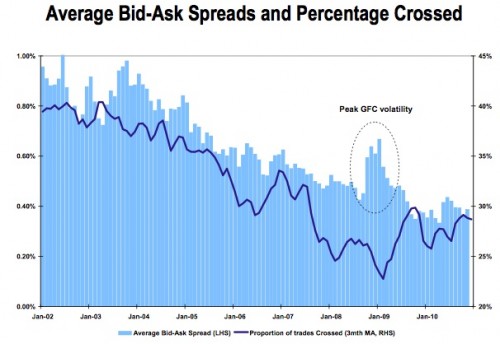

And the net benefit to the market? As we’d expect when effectively ‘more’ traders enter the market, the average bid/offer spread has contracted.

But at what cost – illusory liquidity?

So far, so good. But the extraordinary growth in volume attributable to HFT and, as a result, it’s market dominant presence on most days has given rise to concerns as to its role in shaping market behaviour. The Flash Crash of 2010, where the Dow Jones first fell and then regained 600 points in a matter of minutes, brought these issues to the fore.

According to a joint SEC and CFTC report (here), the catalyst for the flash crash was a (very) large sell order from a mutual fund entering an already skittish market. The problem was that the order was placed with a focus on volume but not price or time. As the order was executed via a sell algorithm, it mechanically sought to sell without regard to its impact on the market – simply seeking to execute based on 9% of the previous minute’s volume. Once the HFT traders had reached their limits with regards to positions – having bought stock from the mutual fund – they joined the selling as they sought to dump their positions. As this increased the volume going through the market, the sell algorithm dutifully increased the rate at which it was selling. So a high octane game of pass-the-parcel ensued.

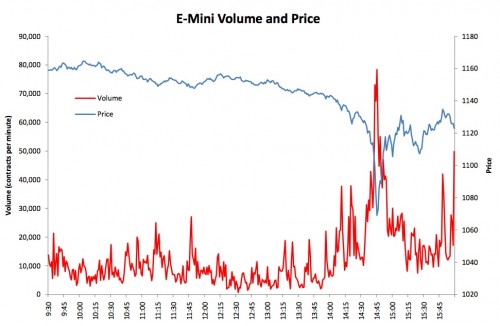

- The combined selling pressure from the Sell Algorithm, HFTs and other traders drove the price of the E-Mini down approximately 3% in just four minutes from the beginning of 2:41 p.m. through the end of 2:44 p.m…

- Still lacking sufficient demand from fundamental buyers or cross-market arbitrageurs, HFTs began to quickly buy and then resell contracts to each other – generating a “hot-potato” volume effect as the same positions were rapidly passed back and forth. Between 2:45:13 and 2:45:27, HFTs traded over 27,000 contracts, which accounted for about 49 percent of the total trading volume, while buying only about 200 additional contracts net.

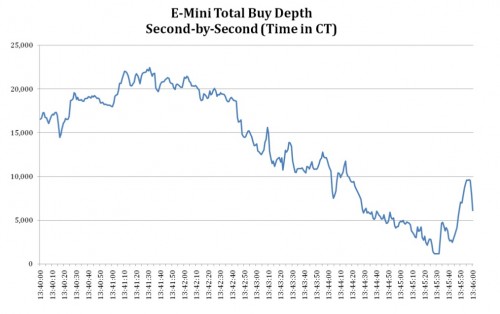

It’s an entertaining read, clearly highlighting the dilemma we face in a HFT environment. So while HFT act like any trader would, it’s their dominance, both in terms of volume and speed, that leads to problems. The machine trader is too fast for mere mortals, but it’s only as smart as the rules that govern its behaviour, and without the discerning touch of the human hand things can go awry very quickly. We can get a sense of the scale from a chart of E-Mini liquidity during the crash – by the second:

Regulators have since developed rules to ensure that there is an enforced pause if market moves too fast too quickly. This is the most logical approach to addressing the problem – at least until the machines take over.

Additionally, regulators have been asking whether limits should be placed on HFT that effectively require them to offer liquidity in erratic markets. For mine, it seems unreasonable to require HFT to become something that its not. And even if such requirements were imposed by fiat, then there must be a commensurate cost that will counteract at least some of the gains that arise to the broader market under stable conditions. As long as there are circuit breakers to stop a machine driven panic, the market can tolerate the absence of liquidity that HFT offers when markets jump, as the price to be borne for the contraction in bid/offer spreads in stable markets.

Or predatory practices?

The ephemeral nature of the liquidity provided by HFT may be marginally annoying, but the real issue around their activities that needs monitoring is the potential for predatory behavior.

Again the issue here is an old one. To recap, in their quest for the spread, traders often leverage their understanding of other market participants. Sometimes this understanding preys on some aspect of the another party’s position that works to the advantage of the trader but disadvantages the primal mover. An example of this is stop loss hunting, where a trader knows that another participant must buy at a higher price, the trader may try to buy into the then lower prices, and effectively chase the market higher until the stop loss is triggered. At that point, the other participant is forced to buy – from the trader. There are other examples, but the essential principle remains the same – the trader preys on another’s position.

While front-running and market manipulation are prohibited by law, the introduction of HFT increases the potential for ‘unfair and unethical’ behavior. Note that the SEC’s enquiry into market structure asked specifically for feedback on ‘order anticipation’ and ‘momentum ignition’ strategies (that would be ‘front-running’ and ‘stop-loss’ strategies but with more syllables). The issue here is that in an area that is already difficult to regulate, the introduction of HFT may further tip the balance in favor of those that might be open to push the envelope.

An example of the greyness of these types of activities is the gaming of ‘liquidity rebates’ – that has grown out of the unnecessary practice whereby exchanges pay rebates to liquidity providers. Most often firms with large retail client bases will ‘internalise’ trades – having these clients sell direct to market makers within the firm, so that that firm can collect the rebate for conducting the trade ‘on-market’. That this ‘internalisation’is a fiction was demonstrated in the Flash Crash where trades that would ‘normally’ be internalised were instead sent direct to the market. This is a practice that is perfectly legal but seemingly unethical. It is made practical in the execution by HFT.

Conclusion – the good with the bad

HFT is a good thing. Like much of our machine enhanced world, it is often beyond the comprehension of us humans, but for the most part it delivers a better outcome in terms of transaction prices for the market. Still the problems that have accompanied trading throughout the ages remain – perhaps obscured a little behind a blur of activity. As Adam would no doubt agree, there is no such thing as a free lunch.

To my way of thinking, the path of least resistance to managing the difficulties around HFT is to ensure that markets remain as transparent as is practically possible – and that means ensuring open access to market data. It’s the same point that the SEC/CFTC concluded on in its report on the Flash Crash:

No comments:

Post a Comment