Gold began the New Year tumble and the bears came out in force to discuss the end of the gold rush. Gold was back up again Thursday, offering us the perfect chance to discuss why fundamentals are still strong. Gold's Pullback Quite a few reasons have been cited for Gold's recent pullback. The first was a change in COMEX margin requirements that showered cold water on traders opening new long positions due to higher cash requirements. Secondly, the Federal Reserve announced an accounting change, saving it from potential bankruptcy. If the Federal Reserve cannot technically go bankrupt, then a major reason for holding gold and silver, the currency crisis, loses some steam in the eyes of some investors. I don't think the accounting gimmick will ultimately eliminate the currency crisis trade, but it buys the Fed some time with the public before they lose confidence in the central bank. A quote from Reuters:

The change essentially allows the Fed to denote losses by the various regional reserve banks that make up the Fed system as a liability to the Treasury rather than a hit to its capital. It would then simply direct future profits from Fed operations toward that liability...

"Any future losses the Fed may incur will now show up as a negative liability as opposed to a reduction in Fed capital, thereby making a negative capital situation technically impossible," said Brian Smedley, a rates strategist at Bank of America-Merrill Lynch and a former New York Fed staffer.

And, recently, the Wall Street Journal found a hedge fund that had liquidated a massive spread of contracts. These positions resulted in a net 100% loss to the hedge fund manager, and he just decided it was time to cut his losses. The selling appeared to panic jittery longs, cascading into more selling.

So is this the end of the great gold bull? I don't think so.

Fundamentals Haven't Changed

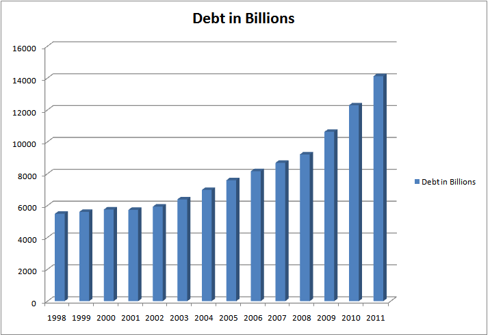

The fundamentals of the gold bull have not changed. For example, we still have massive public debt.

click to enlarge

Data From Treasury Direct

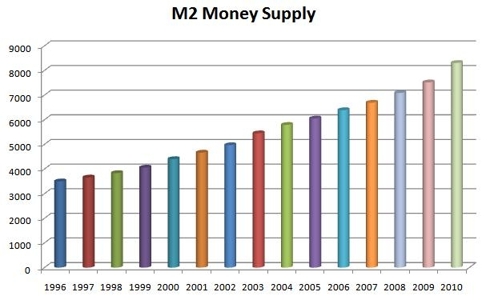

Paper money has also continued to surge. A look at M2 from the Federal Reserve.

A look at Shadowstats money supply charts shows that we had a temporary slight pullback in M3, but that the number has bounced higher so far in 2011.

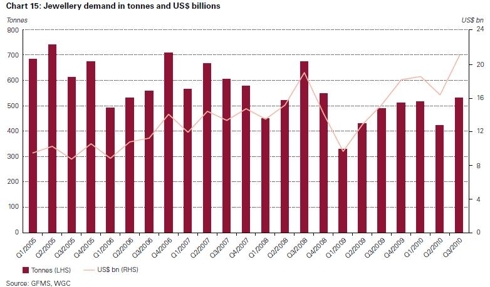

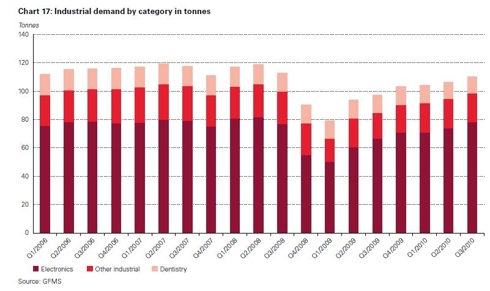

What about demand? The World Gold Council's Q4 report sheds some light on jewelry and industrial demand for gold.

Overall, gold demand is rising faster than supply due to increased jewelry and industrial demand, and net inflow of gold to the official sector (central banks). For the first time in two decades, central banks experienced a net inflow of gold.

Who is Buying Gold?

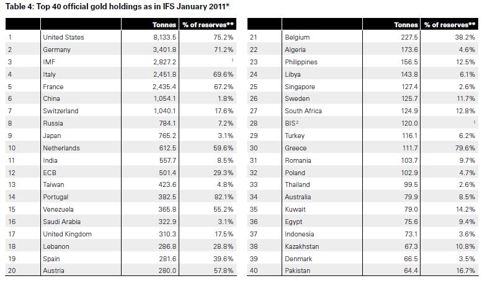

Russia continues to be a gold bull by moving past Japan for 8th in the world on the reserves list.

In the first ten months of 2010, Russia added 131 tons of gold, about 16% of the country's total gold holdings. Russia has recently announced they will increase their reserves by 100 tons per year, with no end date specified in the buying program.

Marketwatch reports that China is buying gold due to holiday and investment demand. China's high rate of inflation has prompted investment by a citizenry that saves 30% of their income, which is in line with historical patterns.

“The Chinese will buy more and more gold just as every other civilization has in inflationary times and with their high savings rates, they have the money to do it,” Pinkowski said.

To wit: China has increased private demand for gold by 22% since 2005, according to BullionVault.

Precious metals traders in London and Hong Kong are “stunned” by gold orders from China, which increased gold holdings by 209 tons in the first 10 months of 2010. According to Goldcore, the physical gold market is becoming less liquid, indicating the selloff is over.

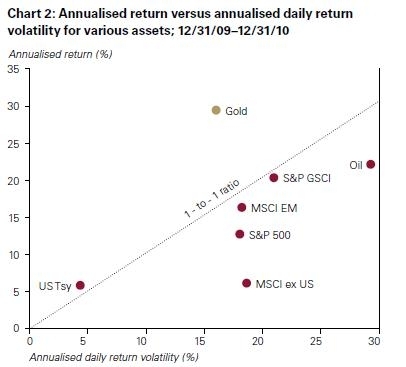

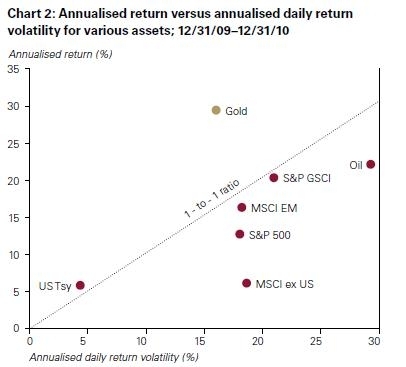

And when compared to other asset classes, gold delivers more return for its daily volatility than other asset classes do.

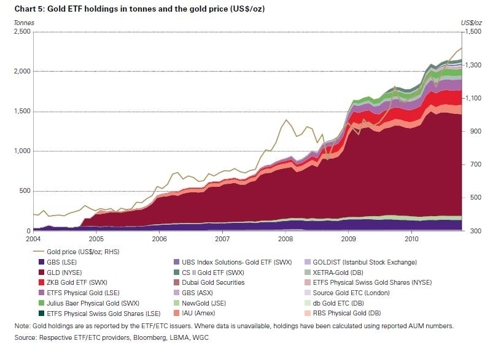

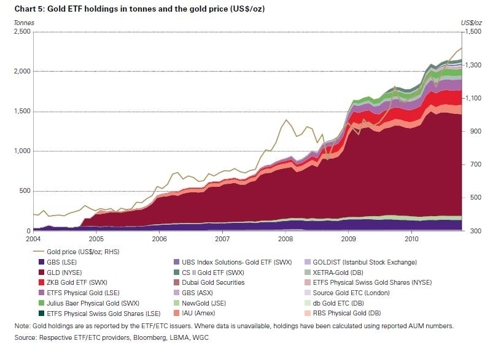

Gold ETFs are also booming.

Another interesting note about China from the World Gold Council report is that while Westerners have increased their gold recovery from scrap, much of it from the retail sector selling gold, Asia has reduced their scrap recovery. Are Westerners in effect selling their gold jewelry to China?

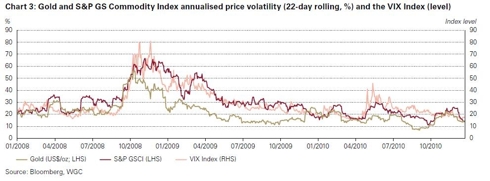

But Gold is Volatile

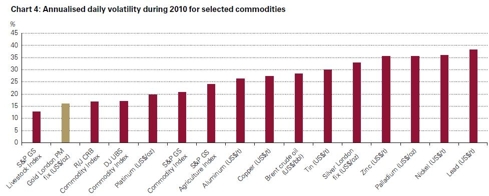

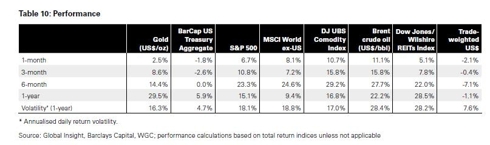

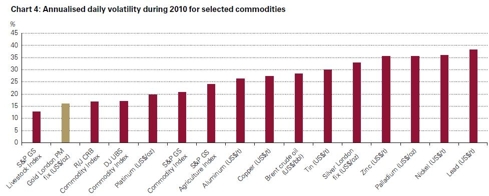

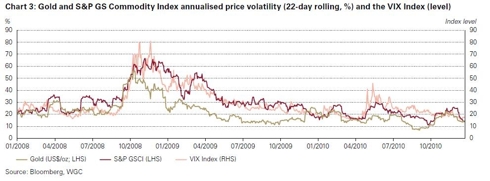

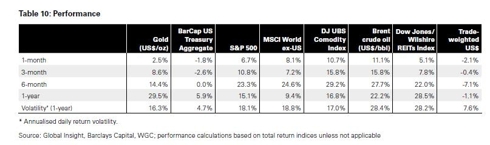

Well, that depends on how you look at volatility. Returning to the World Gold Council Study, we see that compared to other commodity investments, gold is much less volatile.

And when compared to other asset classes, gold delivers more return for its daily volatility than other asset classes do.

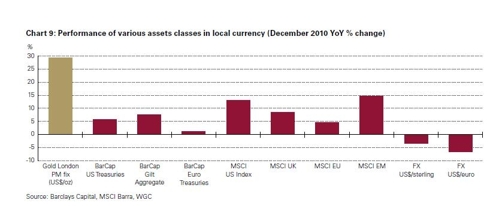

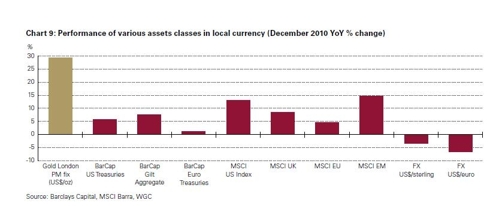

And straight up versus other asset classes, gold is all good.

So, is gold going to be a good investment in 2011? I dunno. But so far, so good. [..]

No comments:

Post a Comment