Example: Let's assume a hypothetical gold miner "A" can extract gold from ground with average "cash cost" of $700 per troy ounce of gold. In addition, let's assume that all other costs related to the ongoing mining operations (depreciation of assets, etc.) are $200/oz. With an average gold selling price of $1300/oz the company makes pre-tax profit of $400 per ounce. If the price of gold changes 10% in this hypothetical case (i.e. $130, up to $1430 or down to $1170) the profit changes 33% (i.e. $400 plus/minus $130).

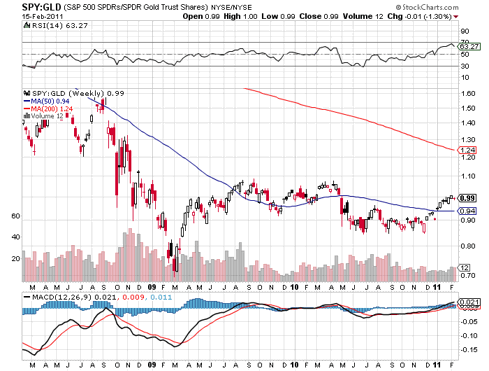

Gold vs. Stock Market

Let’s examine some charts to see how gold and gold mining stocks have done in the past three years. The first chart shows how an S&P 500 index fund (SPY) fell in relation to SPDR Gold trust (GLD). This gives an idea of gold as hedge against financial meltdowns or panics.

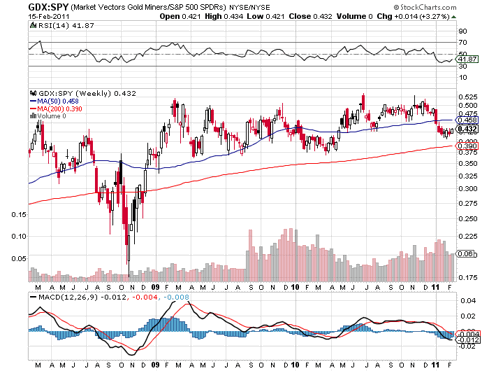

Gold Miners vs. Stock Market

Shares in gold miners did not behave that well. The second chart shows how an index fund tracking gold miners (GDX) have moved in relation to an S&P 500 index fund (SPY). Shares of gold miners fell much more dramatically than the rest of the market during 2008 hitting lows in October 2008. Since then, gold miner stocks have recovered nicely.

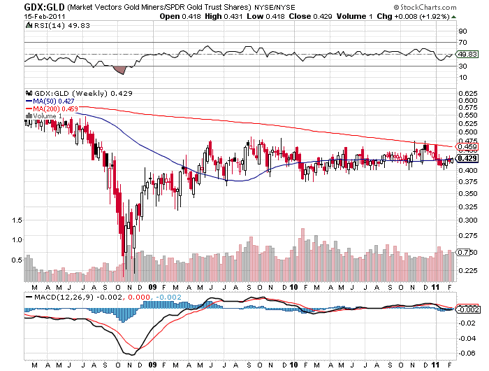

Gold Miners vs. Gold

The third chart shows how an index fund tracking gold miners (GDX) have moved in relation to SPDR Gold trust (GLD). It is quite obvious that in the past three years gold miners have done worse than the gold itself.

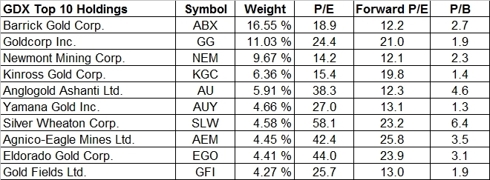

There can be many reasons why gold have beaten a broad passive index of gold miners. The Top 10 holdings of Market Vectors Gold Miners (GDX) are listed below.

The valuations of these companies look reasonable when looking at “forward P/E,” which uses forecasted earnings for the next fiscal year for the calculation. The companies certainly do not appear to be cheap unless you happen to believe in rising gold price or rising mine output or both. One explanation for why gold mining stocks haven’t outperformed the commodity itself lies probably in the valuations of these companies. Obviously, the expectations for gold price and mine output were at a much higher level in beginning of 2008 than today. On the other hand, if you bought miners in October or November 2008 then you have seen a much larger gain than if you had invested in the gold itself.

In the long term, I believe that if the price of gold continues heading north the stocks of gold miners that remain fully exposed to changes in gold price will outperform the commodity itself. My favorites in this sector are Barrick Gold (ABX) and Newmont Mining (NEM). They are among the biggest gold miners and have huge reserves. Most of their mines are located in relatively stable regions. And last but not least - they are conservatively valued compared to many of their peers.

No comments:

Post a Comment