By Julian Murdoch

As gold prices skyrocketed last year, so too did investment demand, according to the World Gold Council's recent Gold Investment Digest.

Although gold has since pulled back from its record $1,400/oz level, gold prices were still substantially higher in 2010 than the previous year. Last year, the average price of gold rose 25.9 percent year-over-year to $1,224.52, up from $972.35 in 2009. Much of that was driven by investment in ETFs and physical gold, as U.S. unemployment and lingering fears of further economic difficulties in Europe continued to support gold as a safe haven.

ETFs: Surprises In GLD, India

(Click to enlarge)

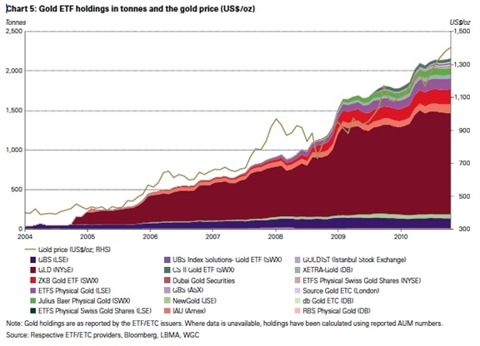

ETF holdings monitored by the World Gold Council continued to grow in 2010, though not as quickly as we saw in 2009 — 361 tonnes vs. 617 tonnes. Still, by year-end, ETFs held a whopping 2,167.4 tonnes of metal.

GLD saw the year's largest gains, with 147.1 tonnes added to the fund during 2010 to reach a total of 1,280.7 tonnes. But it's interesting to note that since the report's publication, GLD's holdings have dropped by more than 55 tonnes — its lowest levels since last May.

This is a case where optimism can hurt. As Ong Yi Ling, investment analyst with Phillip Futures in Singapore, noted to TradeArabia, "The ETF is decreasing due to the optimism in the US economy. If we see concerns on unemployment coming back to haunt us, then perhaps we could see the ETF holding start to increase again." ... [..]

No comments:

Post a Comment