I often write about Treasuries, the dollar and currencies, and at first glance I realize that these subjects may seem to be unrelated enough to avoid altogether. Because they are boring, let’s face it. But we need to be aware of what’s going on in Treasuries, the dollar and currencies, because these mediums are prisms through which we understand commodities.

If gold was priced in chickens, wheat priced in silver or natural gas priced in lean hogs, then we could avoid talking about dollars.

But as it stands, you literally can’t understand what’s going on in commodities without first understanding what the heck is going on with currencies. And right now, we’re on the precipice of an important, long term trend in Treasuries that should play out over the next decade, and possibly longer.

First, a little backstory:

In early 1965, 10 Year Treasury yields briefly dipped below 4.2%. They peaked 16 years later in 1981 at over 15.32%. Rates wouldn’t get back down below 4.5% for 37 years until 2002. My point is: buying 10 Year Treasuries (or any Treasuries, for that matter) in 1965 would have been disastrous.

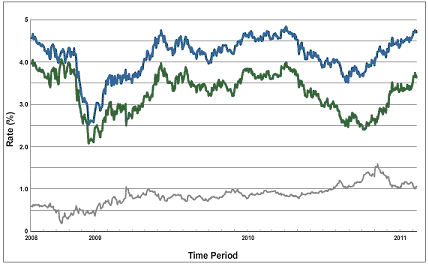

Today, we’re in similar circumstances. Below, I’ve plotted the 10 Year Treasury Yield (in green) alongside the 30 Year Treasury Yield (in blue):

If gold was priced in chickens, wheat priced in silver or natural gas priced in lean hogs, then we could avoid talking about dollars.

But as it stands, you literally can’t understand what’s going on in commodities without first understanding what the heck is going on with currencies. And right now, we’re on the precipice of an important, long term trend in Treasuries that should play out over the next decade, and possibly longer.

First, a little backstory:

In early 1965, 10 Year Treasury yields briefly dipped below 4.2%. They peaked 16 years later in 1981 at over 15.32%. Rates wouldn’t get back down below 4.5% for 37 years until 2002. My point is: buying 10 Year Treasuries (or any Treasuries, for that matter) in 1965 would have been disastrous.

Today, we’re in similar circumstances. Below, I’ve plotted the 10 Year Treasury Yield (in green) alongside the 30 Year Treasury Yield (in blue):

Treasury yields bottomed in late 2008/early 2009 as investors dumped just about everything in favor of the relative perceived safety of Treasuries. Ironically, or perhaps not so ironically, that period was among the worst times in the last 30 years to invest in long-dated Treasuries.

Since then, some of the best and brightest economists and prognosticators in the market have been pounding the table to short government bond prices.

“The Investment of the Decade!”

That’s how these folks have been describing this opportunity. And I agree with them. Interest rates will rise, bond prices will plummet, and some people will make a boat-load of money shorting bond prices.

They remember the multi-decades long period when you could have doubled your money, year after year, doing nothing but shorting Treasury prices. The main problem with this strategy is that Treasury bond yields, though dependent on immutable market forces, are also subject to the whims and fancies of politicians.

These yields can and do get pushed up, down and all around by the machinations of the Federal Reserve, the United States Treasury, and assorted intermediaries and overseers. In other words, making an investment, short or long, based on US Treasuries puts your money in the way of the many and sundry political forces running this country.

A much easier and less complicated way to invest based on perceived dollar weakness or relative strength is to simply buy (or sell) physical gold or silver.

I understand that buying gold or silver doesn’t exactly follow the same line of thought as shorting Treasuries, but the effect can be largely the same under most circumstances.

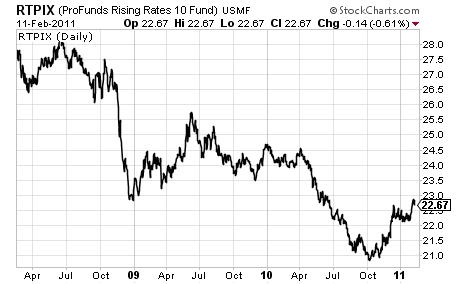

Today, if you want to short Treasuries, there are a few short bond funds to choose from, but even though rates have risen from the early 2009 lows, these funds haven’t performed very well. One of the most popular funds, the ProFunds Rising Rates 10 Fund (RTPIX) lost money during this period.

That’s not to say that it won’t succeed in the future as rates continue to rise, but the other downside to this fund, and others like it, is the $15,000 minimum initial investment.

Now, I want to reiterate- the investment thesis behind buying such a fund is that you believe rates will rise precipitously for the foreseeable future. Again, that’s not the same reason that you’d purchase gold or silver. But the fact that rates are too low right now generally tends to be a positive catalyst for owning gold and silver.

So, not exactly the same thing – but right now, buying gold and silver is easier and cheaper.

No comments:

Post a Comment