How Traders Exploit Changes in the Shape of the Yield Curve

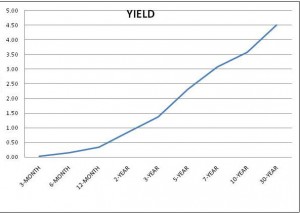

In bond trading 101, we discussed how professional bond traders trade on expectations of changes in interest rates (referred to as “outrights”). Bond traders also trade based on expected changes in the yield curve. Changes in the shape of the yield curve will change the relative price of bonds represented by the curve. For example, suppose you have a steeply upward sloping yield curve like the one below:

On this curve the 2-year is yielding 0.86% and the 30-year is yielding 4.50%- a spread of 3.64%. This may lead a trader to feel that the 30-year was cheap, relative to the 2-year. If that trader expected the yield curve would flatten, he could simultaneously go long (buy) the 30-year and sell short the 2-year. Why would the trader execute two simultaneous trades rather than simply buying the 30-year or selling short the 2-year? Because if the yield curve flattens, reducing the spread between the 2-year and the 30-year, it could be the result of the price of the 2-year falling (increasing the yield), or the price of the 30-year increasing (decreasing the yield), or a combination of the two. For the trader to profit from just going long the 30-year, they would be betting that the flattening of the curve will be the result of the price of the 30-year going up. Similarly, if the short the 2-year they are betting that the price of the 2-year will decline. If they take both positions, they do not have to know in what way interest rates will move in order to make a profit. Such trades are “market neutral” in the sense that they are not dependent on the market going up or down in order to make a profit.

In this and in subsequent lessons, we will explore ways that professional bond traders anticipate changes in the shape of the yield curve and trade on these expectations.

So what is the driving force that determines the shape of the yield curve? As it turns out, Federal Reserve monetary policy in response to the economic business cycle determines the shape of the yield curve as well as the general level of interest rates. Some traders will use economic indicators to follow the business cycle and try to anticipate fed policy, but the business cycle is very difficult to follow, while the Fed is very transparent about their policy decisions, so most traders follow the Fed. Think back to our discussion in Bond Trading 102: Forecasting Interest Rates. There we stated that when the Fed sets the level of the fed funds rate, it directly influences short-term rates, but has less of an impact the further out you go on the yield curve. Because of this, changes to the fed fund rates have a tendency to change the shape of the yield curve. When the Fed increases the fed funds rate short-term rates tend to increase more than long-term rates, thus flattening the yield curve. A flattening curve means the spreads between short-term treasuries and long-term treasuries are narrowing. In this environment, traders will buy longer term treasuries, and short shorter term treasuries. An inverted yield curve is the result of the Fed pushing short-term rates to very high levels, but investors are expected that these high rates will soon be lowered. An inverted yield curve is often an indication that the economy is heading into a recession.

When the Fed lowers the fed funds rate, the yield curve tends to steepen, and traders will tend to buy the short end and short the long end of the curve. A steep positively sloped curve results from the Fed maintaining low short-term rates, but investors are expecting rates to rise. This usually occurs towards the end of a recession and is often an indication that the economy is about to turn around.

How Traders Establish Strategic Curve Trades

Professional bond traders structure their strategic yield curve trades to be market neutral[1](also referred to as duration neutral) as they only want to capture changes in relative rates along the curve and not changes in the general level of interest rates. Because longer maturity bonds are more price-sensitive than shorter term bonds, traders do not go long and short equal amounts of short-term bonds and long-term bonds, they weight the positions based on the relative level of price sensitivity of the two treasuries. This weighting of the positions is known as the hedge ratio. As was pointed out in Debt Instruments 102 in the discussion of duration and convexity, the price sensitivity of bonds changes with the level of interest rates. Bond traders, therefore will not keep the hedge ratio constant over the life of the trade, but will dynamically adjust the hedge ratio as the yields of the bonds change.

While there are different ways to measure the price sensitivity of a bond, most traders use the measure DV01, which measures the price change that a bond will experience with a 1 basis point change in interest rates. For example, if the DV01 of a 2-year bond is $0.0217, and the DV01 of a 30-year is $0.1563, the hedge ratio would be 0.1563/0.0217, or 7.2028 to 1. For every $1,000,000 position the trader takes in the 30-year, he would take an opposing position of $7,203,000 in the 2-year. As interest rates change, the trader would recalculate the DV01 of each bond and adjust the positions accordingly.

Flat or inverted yield curves provide bond traders with unique strategic curve trade opportunities, since they are not encountered very often and generally do not last very long. They usually occur near business cycle peaks when the Fed is holding the fed funds rate at significantly high levels. When fed funds rates are unusually high, investors at the longer end of the curve do not expect these high rates to prevail over the long term, so yields at the long end do not rise as much. Traders will exploit this by shorting longer maturities and going long shorter maturities.

Another opportunity that does not present itself very often occurs during times of extreme economic turmoil when financial markets experience significant sell-offs. During these periods, investors will sell their equity and lower rated debt investments and buy short-term treasuries. This phenomenon is referred to as a flight-to-quality. Short term treasury prices shoot up, causing a steepening of the yield curve, particularly prominent in the very short end of the curve. Traders will often sell short the short-term treasuries while buyer treasuries further out on the curve. The risk with this trade is that it is hard to judge how long it will take for yield spreads to adjust back to more normal levels.

Factors that influence the P & L of Strategic Curve Trades

Changes to the relative yields of the bonds in a strategic curve trade are not the only determining factor to a trades profit or loss. The trader will receive the coupon interest in the bond that they are long, but will have to pay the coupon interest on the bond that they borrowed to sell short. If the interest income received from the long position is greater than the income paid on the short position, the profit is enhanced, if the interest paid exceeds that which is received the profit is reduced, or the loss is increased.

When a trader goes long the short end of the curve and shorts the long end, the proceeds of the short is not sufficient to cover the long position, so the trader will have to borrow funds to purchase the long position. In this case, the cost of carry must be factored into the P&L of the trade. These trades that require borrowing to finance cash shortfall between the purchase and short sale are said to have negative carry, while trades that have short sell proceeds that exceed the purchase amount are said to have positive carry. Positive carry adds to the P&L because the excess cash can earn interest.

Advanced Strategic Curve Trades

Professional bond traders also have strategies to deal with perceived anomalies of the yield curve shape. If a trader sees an unusual convex hump in a section of the curve there is a strategy to make a bet that the hump will flatten out. For example, if there is a hump between the 2-year and the 10-year, the trader will take a duration neutral short position in the 3-year and 10-year and buys a treasury in the middle of the range of the same duration.

In this example the 7-year would do. If the anomaly was a concave dip in the curve, the trader could buy the short and long-term bond, and sell short the intermediate; however this trade would entail negative carry, so the trader would have to have a strong belief that the anomaly would be corrected and that the correction would cause a considerable change in relative prices.

No comments:

Post a Comment