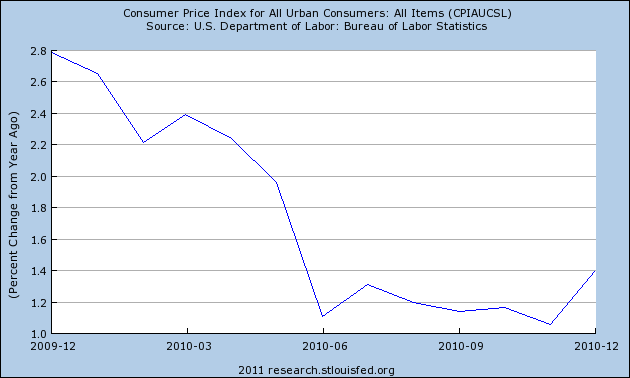

A little over a year ago I said inflation concerns in the USA were blown out of proportion and that we were likely to see an environment of disinflation “with a greater risk of deflation than hyperinflation”. One year later that’s clearly what has occurred in the USA as disinflation ensued. Overall inflation has continued to decline and deflationary fears became so substantial in Q3 2010 that the Fed panicked into implementing QE2. In retrospect, it looks like the Fed jumped the gun as September economic data proved that the summer slowdown and double dip fears were overblown (not that it matters as we remain mired in one continuous balance sheet recession). The good news is we’re not repeating the mistakes of Japan (yet), but we’re also not growing fast enough to meaningfully close the output gap.

But where are we now? Is deflation still the greater risk? What about commodity prices and global inflation? How is this all going to play into the USA’s future inflation/deflation problems?

One thing we know from the credit crisis is that the Fed’s various “money printing” operations have had a far lesser impact on the rate of inflation than most presumed they would. Despite an explosion in the monetary base inflation is near its lows. As I’ve previously discussed, this unusual recession (a balance sheet recession) exposed many flaws in the way we understand the functions of modern banking. The primary myth that has been exposed in recent months is the money multiplier.

Because we’re working in an unusual environment we have to throw out the old playbooks when estimating future rates of inflation. The Fed’s actions are and will continue to be relatively futile in influencing future inflation. Fiscal policy remains intact, however, is likely to come under increasing pressure in the coming years. All of this occurs during a process of de-leveraging by the private sector.

From a demand-pull perspective the story remains little changed from last year. This environment of low capacity utilization and tepid aggregate demand is likely to result in benign inflation. This is due to the continuing strains at the consumer level. A lack of job growth, de-leveraging, falling house prices, etc are likely to continue exerting pressures on the U.S. consumer in the coming years and make demand-pull inflation unlikely .... [..]

No comments:

Post a Comment