by Sober Look

US middle market leveraged buyout (LBO) transactions are becoming increasingly frothy. According to the latest data from Lincoln International, risk-return fundamentals in the space are worse than they were in 2007. Here are some disturbing facts about leveraged transactions in US middle markets:

1. Leverage multiples (debt to EBITDA) are higher than at the peak of the bubble in 2007. In particular, leverage through the senior debt (dark blue) is now materially higher.

2. Yields on senior leveraged loans for middle market deals are now significantly lower than in 2007. Investors are not getting paid for taking on riskier loans.

3. Furthermore, private middle market company valuations (as a multiple of EBITDA) are at record levels.

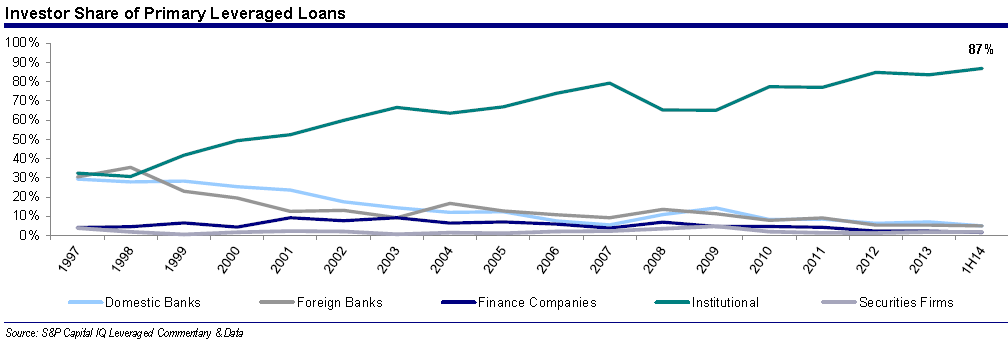

4. Banks have all but exited leveraged loan origination, as institutions (shadow banking) have taken over. These institutions include loan funds (mutual funds and closed-end funds), BDCs, CLOs, hedge funds, insurance firms, pensions, etc. However, since the Fed is mostly looking at banks' balance sheets, the central bank seems to be unconcerned about the froth in this market.

5. According to Lincoln International, there are signs that leveraged middle market firms are experiencing margin compression. That is worrisome given the amount of leverage these firms have.

Lincoln International: - While over 50% of companies are seeing revenue growth, the fact that over 50% are experiencing EBITDA declines suggests margin compression. For the sixth consecutive quarter, more middle market companies experienced EBITDA declines than gains.

The Fed has allowed for bubble to build in the US corporate sector - particularly in leveraged middle market companies. A broad hit to revenues could create a massive wave of failures, as firms become too leveraged to withstand such a shock. At the same time investors could face significant losses without being compensated for the risk they are taking. Let's hope someone on the FOMC is paying attention.

No comments:

Post a Comment