by Bill Luby

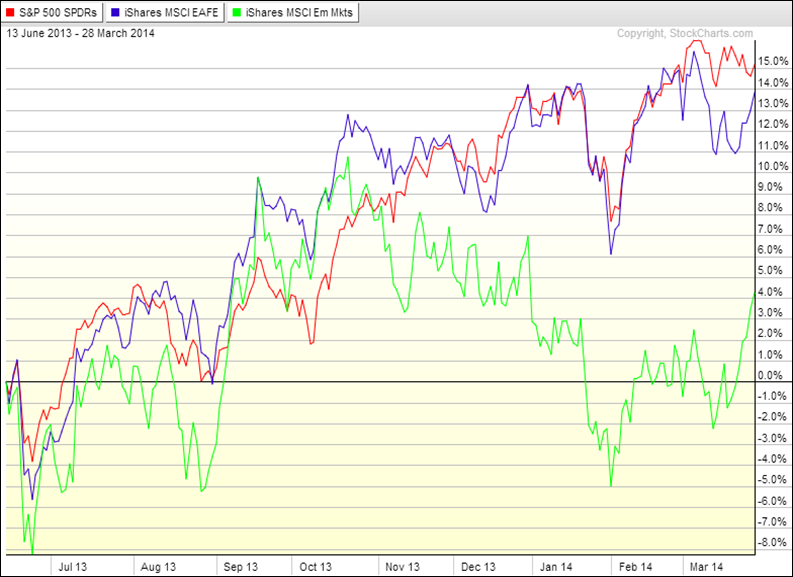

| While I have a long way to go before I become the next Manny Mota, yesterday I was delighted to be able to pinch hit for Steve Sears of Barron’s for the twelfth time, when I penned Emerging Market Stocks: Have They Hit Bottom? as a guest columnist for The Striking Price. In the Barron’s article I talk about how rapidly increasing uncertainty and risk in emerging markets during January was largely responsible for the 31.7% VIX spike on January 24, but was nowhere near the levels of June 2013, at least as measured by the CBOE Emerging Markets Volatility Index (VXEEM). I also used the VXEEM:VIX ratio and some other data to support the idea that emerging markets have likely bottomed and are poised for a bounce. I concluded the Barron’s column with a couple of options trade ideas to take advantage of a reversal in emerging markets. When I wrote the article, on Tuesday, my position on emerging markets was very much a case of going out on limb. By Friday’s publication date, which includes Tuesday’s option pricing data, emerging markets had already experienced a significant bounce and my emerging markets thesis no doubt sounded much less provocative than it would have three days earlier. [source(s): StockCharts.com] In any event, I strongly believe that emerging markets (EEM) and VXEEM bear close watching going forward, as the Fed moves toward a new policy direction, emerging markets grapple with rising interest rates in the U.S. and the global economic growth story has many critical ripple effects across the full emerging markets landscape. |

No comments:

Post a Comment